Multi-Factor Authentication is Now Available in MerusCase

Multi-Factor Authentication (MFA) is now live in MerusCase allowing firms to proactively strengthen firm’s cyber security. MFA is an authentication method that requires users to provide two or more verification factors to gain access to MerusCase. This additional layer of security ensures all of your confidential case and client information is kept secured and protected from third parties while reducing the possibility of a breach.

Administrators in MerusCase can now choose to enable MFA for all users in their firm, or only select users. Once MFA is enabled for a user, they will be immediately logged out and required to set up MFA for their individual accounts. Let’s explore how it works.

Read More

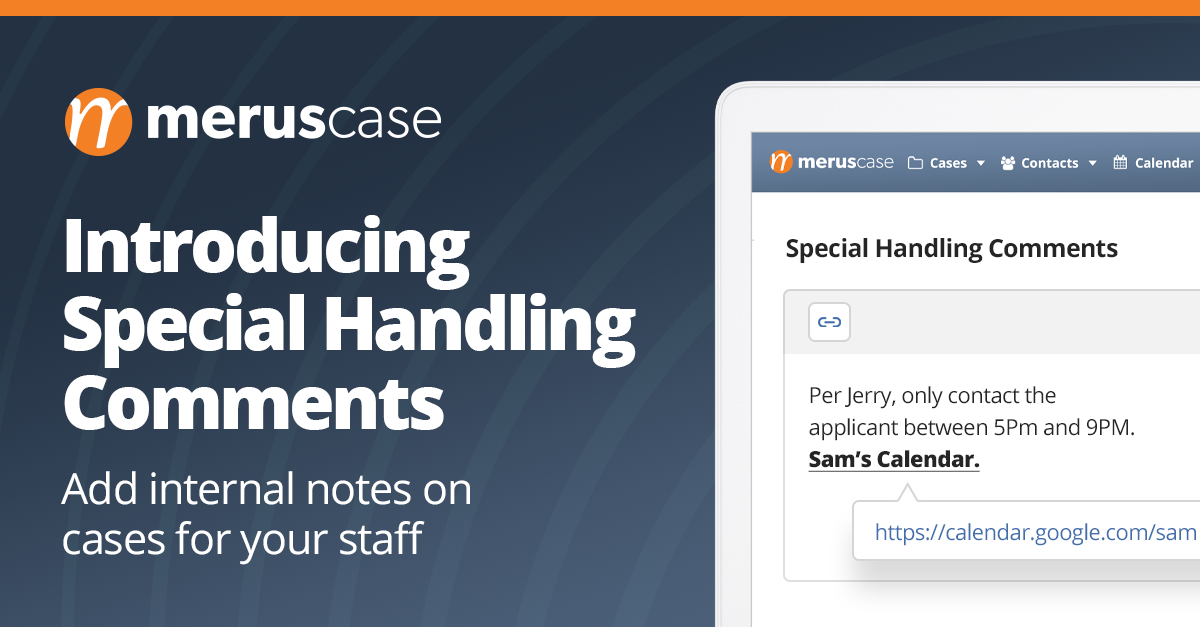

Never Miss Important Case Information Ever Again — Introducing Special Handling Comments

Using our new Special Handling Comments, your firm can ensure that important information is always relayed to your staff and will never be missed again.

Administrators in MerusCase can now add Special Handling Comments to cases. These comments can be whatever you’d like; for example, you may want to communicate to your staff that a certain party on the case should only be contacted at certain times. Or you may want to communicate the desired way to bill for the case.

Once the Special Handling Comments are added, an alert will appear on the screen every time any user clicks into that case. The alert will contain the notes added by the administrator. The Special Handling Comments improve communication across departments and ensure that all users at your firm see essential information.

Get Paid Faster With MerusPay, Now Available In MerusCase!

Embrace a new and easy way to accept online payments! Today, MerusCase is excited to announce the launch of MerusPay — our seamless in-house payments experience that allows your firm to get paid quickly and compliantly without ever leaving MerusCase.

Read MoreMerusCase 2021: Year in Review

Wow, what a year it has been! 2021 brought some of the same, and some of the new as we continue to live through and evolve with an ever-changing global pandemic. Through the ups —and downs — of the last 12 months, we’ve been proud to serve our loyal customers and we’re excited to tackle the challenges of 2022 together.

Read MoreLegal Research Available Within MerusCase

The law is always changing, and staying up-to-date with the most recent rulings is crucial to the continued success of your firm. We've partnered with AnyLaw for our latest feature release! Now you’ll be able to initiate legal research from anywhere within the MerusCase application at no additional cost — giving you the ability to seamlessly search by topic, jurisdiction or even by recently decided cases.

AnyLaw's free legal research platform has full coverage of US state and federal case law. The data is drawn from a multitude of resources and includes archival and current case law, as well as just released slip opinions.

Read More

.png)

.png)

Leave a Reply